what is Impulse Waves

There are several rules regarding the characteristics of waves. Impulse Waves is one of them. These rules are inviolate. To violate a rule is to disregard the Elliott Theory and, almost certainly, to arrive at an incorrect conclusion and projection. Although there are not many rules, it is important to remember that they are strict rules that cannot be violated.

The six rules for impulse waves are as follows:

1. Impulse waves move in the same direction as the trend of the next higher degree wave.

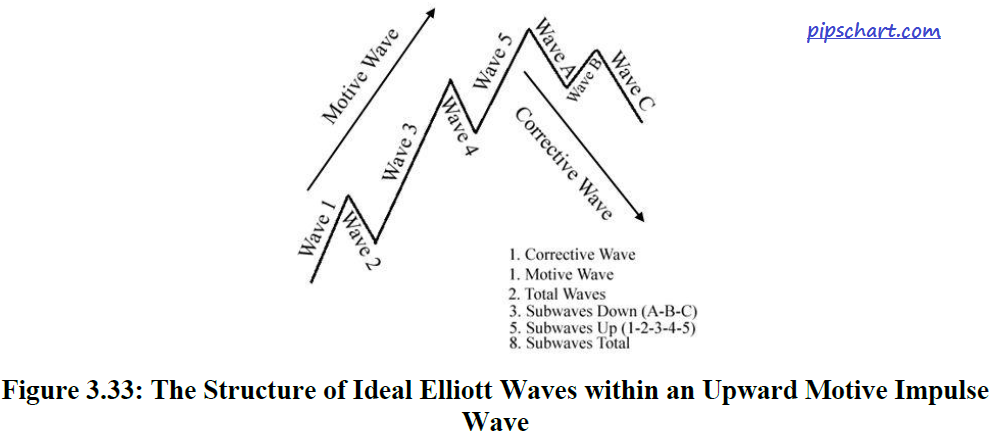

2. Impulse waves divide into five sub waves.

3. Within an impulse wave, sub waves 1, 3, and 5 are themselves impulse waves of a lesser degree, and sub waves 2 and 4 are corrective waves.

4. Within an impulse wave, sub wave 1 and 5 may be either an impulse or diagonal pattern.

5. Within an impulse wave, sub wave 3 is always an impulse pattern.

6. In cash markets, within an impulse pattern, sub wave 4 never overlaps any portion of

7. Sub wave 1. This is not always true for futures markets.

In addition to the inviolate rules, Elliott observed other wave characteristics that routinely occurred. Elliott’s observations were made without the advantage of computer power to sift through large amounts of data, and he used only the Dow Jones Industrial Average. The observations we include in this chapter are observations from computer screens of price action in many different trading markets and over many different periods (Swannell, 2003).

Most of these observations agree with Elliott’s assessments, but some differ slightly. Nevertheless, the computer screens display that his observations were mostly accurate.

Impulse

Impulse patterns define the trend direction and strength. They include five sub waves, three of which move in the direction of the trend and two of which move in the direction opposite to the trend. A rising market generally has two strong sub waves: 3 and 5. In a declining market, sub wave 3 is generally the strongest, and sub waves 1 and 5 are approximately equal.

Elliott Theory describes the character of each sub wave in more detail. The details of these sub waves are as follows:

• Wave 1 is an impulse or a leading diagonal.

• Wave 2 can be any corrective pattern but a triangle.

• Wave 2 does not retrace more than 100% of wave 1.

• Wave 3 is always an impulse.

• Wave 3 is larger than wave 2.

• Wave 3 is never shorter than waves 1 and 5.

• Wave 4 can be any corrective pattern.

• Waves 2 and 4 do not overlap in price.

• Wave 5 is an impulse or ending diagonal.

• Wave 5 retraces at least 70% of wave 4.

• In the fifth wave, a diagonal, extension, or truncation indicates that a major reversal is to occur soon.

Next to continue ……………..

0 thoughts on “what is Impulse Waves”