A wave,what make sense your view

Elliott’s theory describes the market structure as a nested series of waves of various length and size. A wave is a sustained price move in one direction as determined by the reversal points that initiated and terminated the move. A wave cycle has two waves. One an impulse wave and Secondly a corrective wave.

The impulse wave is in the direction of the current trend; the corrective wave moves against the trend’s direction. During a bull market, the overall trend is called a “motive impulse wave” (upward price movement) and ends when a downtrend begins, signaling a major change in market direction.

The wave concept that a market has positive price movement followed by a correction is simple. The benefit of EWT is that it provides the analyst with more detail about these waves. Both the impulse wave and corrective waves include special sub waves. The impulse wave is always made up of five sub waves and determines the strength and trend of the wave cycle.

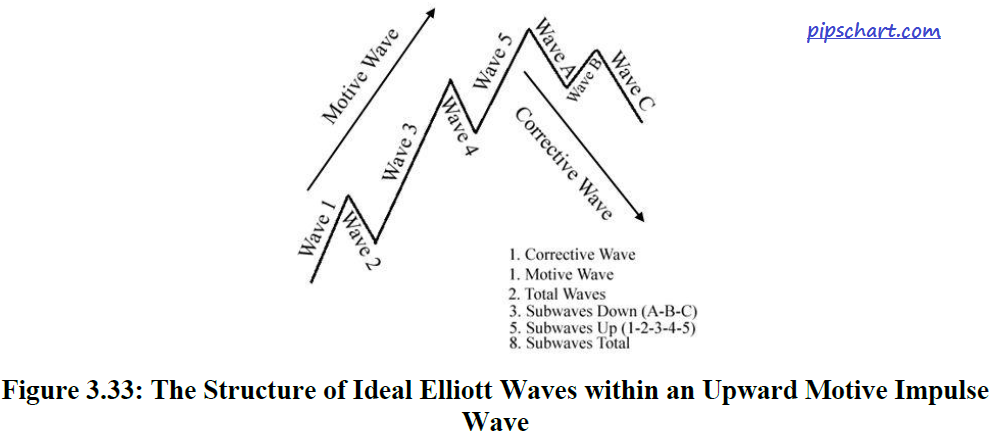

Analysts traditionally label these waves with numbers (1, 2, 3, or I, II, 111, or i, ii, iii, etc.) based on their degree relative to longer and shorter wave cycles. See waves 1 through 5, for example, in Figure 3.33 Waves 1, 3, and 5 are smaller waves that contribute to the larger wave’s upward trend. Waves 2 and 4 are corrective sub waves; these corrective waves break the sustained upward movement.

The corrective wave is broken into three sub waves, rather than five. These sub waves are labeled with letters, such as A, B, and C, as shown in Figure 20.1. Waves A and C are associated with downward price movement. Wave B breaks this downward movement with an uptrend.

In describing the specific sub waves, analysts assume an upward underlying trend at the next higher degree and thus a rising five-wave impulse wave and a declining three-wave corrective wave. We will use the same convention, but the student must be aware that in an underlying downward trend, the same relationship between impulse wave and corrective wave holds, just in the opposite direction. In other words, the downward impulse wave would include five sub waves and three sub waves in its corrective wave upward.

Look at Image :

See how the upward motive impulse wave consists of three rising impulse sub waves, coinciding with the primary trend, and the corrective wave consists of two corrective sub waves, contrary to the primary trend. This pattern can be thought of as three steps forward and two steps backward, with each step followed by a small correction.

Focus Figure 3.33 :

Figure 3.33 demonstrates how the two waves of the cycle, the impulse and corrective waves can be broken down into smaller sub waves. Each of these sub waves can be broken into separate patterns. Interestingly, the patterns of each sub wave will form the same general impulse and corrective Elliott pattern with and against their trend.

In other words, the patterns generated from the waves are fractal, a term we used earlier in describing how chart patterns of a specific type can exist in identical shapes in very short- as well as long-term charts. The patterns remain the same regardless of time or scale.

Each series of waves will define a pattern within a pattern both up and down the scale. Unfortunately, the patterns do not have definitive time limits. One of the major problems of the interpretation of Elliott waves is in deciding at what degree level a particular pattern exists.

Often the shape of the wave can be interpreted as being part of one degree of magnitude of waves, when it really is part of a larger or smaller degree of waves. These different interpretations may have different implied consequences, making projections even more difficult.

To establish the order of the waves being analyzed, analysts generally begin with a long-term interpretation and reduce the inspection of waves through lower and lower degrees until the trading horizon is reached. Misinterpreting any of the waves between the long-term pattern and the trading horizon pattern, of course, can alter the interpretation of future prospects as well. Each of the sub waves within either the impulse or the corrective waves can have its own peculiarities and alternative patterns. First, let us look a little more closely at the characteristics of impulse waves. Then we will turn our attention to corrective waves.

0 thoughts on “A wave,what make sense your view”